Canada’s fertility rate has reached a historic low, sparking conversations across the nation about why fewer Canadians are having children.

According to recent data from the Angus Reid Institute, the country’s fertility rate dropped to 1.26 births per woman in 2023, a record low, far below the replacement rate of 2.1 needed to maintain population levels.

This alarming trend has implications for Canada’s economy, workforce, and long-term sustainability. So, what’s driving this decline?

Here are six key factors behind Canada’s dropping fertility rate.

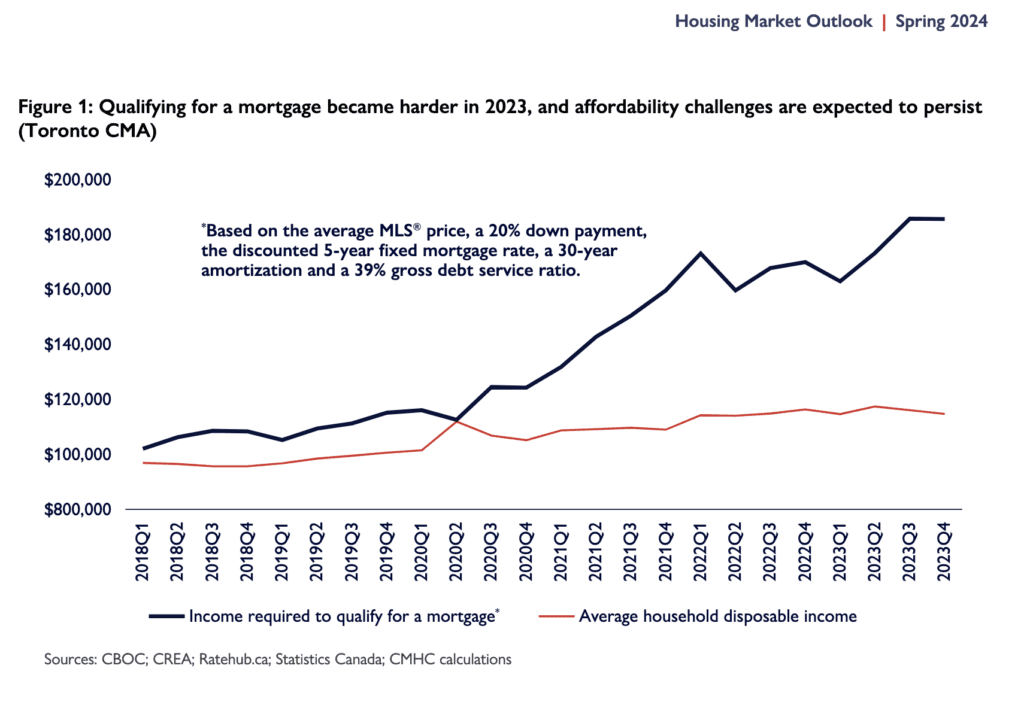

1. Canada’s Soaring Cost of Housing Stops Baby Making

For many Canadians, owning a home has become a distant dream. Over the past decade, housing prices in Canada have surged to record highs. According to the Canadian Real Estate Association (CREA), the national average home price as of 2023 was approximately $720,000, a stark contrast to the $340,000 average in 2010. These rising costs are pushing young adults to stay in the workforce longer, delaying major life milestones like marriage and parenthood.

A growing number of young Canadians are also living with their parents into their late 20s and 30s. Statistics Canada reports that 35% of adults aged 20-34 lived at home in 2022, compared to just 27% in 2001. This report also doesn’t account for people who still live at home but don’t admit it either.

This delay in financial independence means fewer people have the stability or space to start a family.

For couples ready to have children, overcrowding is another hurdle.

Multigenerational households often lack the space and privacy needed to comfortably raise children. Meanwhile, rental prices have also skyrocketed, with average rents for a two-bedroom apartment in major cities like Toronto and Vancouver exceeding $2,300 per month.

The dream of homeownership and family life is increasingly unattainable for many Canadians.

It’s so unatainbale that many Canadians are looking to leave Canada altogether to raise a family. This reverse immigration trends is rising, and it has many Canadians looking for countries with lower living costs and more affordable housing markets to a better quality of life. If you’re looking to leave Canada also, we have the right guide for you:

Explore Your Opportunities Abroad

Use the Canadian Exit Guide to see how you can leave Canada to find better opportunities abroad.

The Correlation Between Housing Costs vs. Fertility Rates

Table 1. A comparison of Canada’s rising housing costs and its declining fertility rates over the past decade.

| Year | Average Home Price (CAD) | Fertility Rate (Births per Woman) | Adults 20-34 Living at Home (%) |

| 2010 | $340,000 | 1.63 | 27% |

| 2015 | $450,000 | 1.54 | 30% |

| 2020 | $600,000 | 1.40 | 33% |

| 2023 | $720,000 | 1.26 | 35% |

What The Canadian Housing Data Tells Us

The data highlights a clear correlation between soaring housing costs and Canada’s dropping fertility rate. Between 2010 and 2023, the average home price more than doubled, while the fertility rate fell by nearly 20%. This trend is compounded by the rising percentage of young adults living at home, indicating delayed financial independence.

With housing costs consuming a significant portion of household income, many young Canadians are unable to save for the future or create the stable environment necessary for raising children. As a result, parenthood is increasingly seen as a luxury rather than a natural life milestone.

This situation underscores the need for systemic changes, such as increased housing affordability and support for young families. Alternatively, for those seeking immediate solutions, emigration to countries with lower living costs may offer a practical way to achieve both homeownership and family goals.

2. The Rising Cost of Daycare

Childcare in Canada has reached crisis levels of affordability, even for families with dual incomes. According to the Canadian Centre for Policy Alternatives (CCPA), the average cost of daycare for a child under the age of five in major cities like Toronto or Vancouver exceeds $1,200 per month, making it one of the highest in the world. While government initiatives such as the $10-a-day childcare program have been rolled out in some provinces, many parents are still paying significantly more.

For families, these rising costs present a stark choice: maintain financial stability or expand their family.

A report from Statistics Canada reveals that families with two children often spend more on daycare than on housing or groceries, a burden that is pushing many to reconsider having additional children altogether.

This financial strain also has broader economic implications. Many women are unable to reenter the workforce after maternity leave because the cost of daycare often outweighs the income they would earn. This “motherhood penalty” not only limits household income but also perpetuates economic inequality, making it even harder for families to thrive.

For some parents, relocating to a country with more affordable childcare and living costs is becoming a viable option. Explore our step-by-step guide to leaving Canada to learn more about starting fresh in family-friendly destinations where your offspring will have a better future than in Canada.

Daycare Costs vs. Household Income

Table 2. A breakdown of the average percentage of household income spent on daycare in Canada’s largest cities.

| City | Average Monthly Daycare Cost (CAD) | Average Household Income (CAD) | Percentage of Income Spent on Daycare (%) |

| Toronto | $1,200 | $100,000 | 14.4% |

| Vancouver | $1,250 | $98,000 | 15.3% |

| Montreal | $200 | $90,000 | 2.7% |

| Calgary | $1,000 | $105,000 | 11.4% |

| Halifax | $950 | $85,000 | 13.4% |

What The Data Shows

The data underscores the financial pressure that childcare places on Canadian families. In cities like Toronto and Vancouver, families are spending over 15% of their annual household income on daycare alone. By comparison, parents in Montreal benefit from heavily subsidized daycare, where costs represent less than 3% of household income, thanks to robust provincial programs.

This disparity highlights the uneven burden of childcare costs across Canada. In regions where fees are not subsidized, many parents—particularly women—are forced to make difficult trade-offs between their careers and family size. These financial realities are a significant contributor to Canada’s dropping fertility rate, as families find it increasingly difficult to support multiple children.

For those seeking a better balance between family life and financial stability, emigration to countries with more affordable childcare systems may be the answer. In these locations, parents can access the resources they need to both work and raise a family without compromising their financial future.

3. Dual-Income Households And Wage Stagnation

Gone are the days when one income could sustain a household. In modern Canada, both men and women must work just to make ends meet or just to afford a mortgage. This leaves little time for family life, let alone raising children.

The balance between work and personal life is one of the biggest challenges for Canadian families. With long working hours and stagnant wages, many people feel forced to prioritize their careers over starting a family.

If this sounds all too familiar, consider how wage decline in Canada might be affecting your situation. Some Canadians are finding better opportunities in countries where work-life balance is more achievable.

3. Wage Stagnation and Rising Costs

Despite inflationary pressures and a rapidly increasing cost of living, wages in Canada have largely stagnated over the past two decades. Between 2000 and 2023, real wages for the average Canadian worker increased by only 0.5% annually, failing to keep pace with inflation, which has risen by approximately 2% annually. As a result, the purchasing power of Canadian households has been steadily eroded, leaving many families struggling to cover basic necessities like housing, food, and transportation.

Housing costs now consume a disproportionate share of income, with the average household spending nearly 35% of its income on housing alone. Meanwhile, food prices have surged, with Statistics Canada reporting a 6.9% increase in grocery costs between 2022 and 2023, the fastest pace in over 40 years. Transportation costs, including fuel and public transit, have also climbed, further straining household budgets.

This economic reality makes it increasingly difficult for young Canadians to consider starting families. According to the Conference Board of Canada, the estimated cost of raising a child to the age of 18 now exceeds $300,000, a figure that is simply unattainable for many. Consequently, the country’s fertility rate has plummeted to a record low of 1.33 births per woman, far below the replacement rate of 2.1.

Adding to the pressure is Canada’s dropping fertility rate is Canada’s declining productivity, which the TD Bank describes as being in “crisis mode.” The nation has seen a drop in goods and services produced per worker, with productivity levels now at their lowest point in two decades. This stagnation further hampers economic growth, leading to job instability and limited wage growth. With fewer opportunities to earn a livable income, many Canadians are delaying or forgoing parenthood altogether.

For a deeper dive into the economic challenges faced by Canada’s youth, including the growing trend of seeking better opportunities abroad, read our article on Canada’s student asylum seekers.

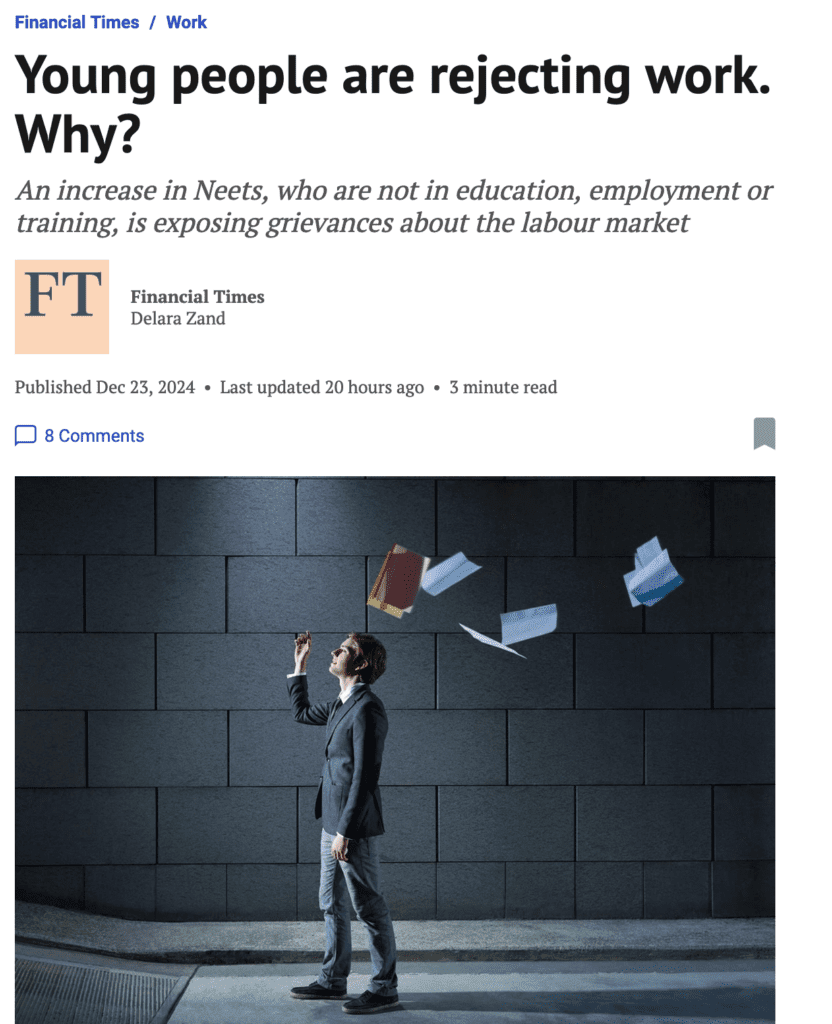

4. Youth Unemployment and Underemployment

Unemployment and underemployment among young Canadians (and new immigrants) are compounding the country’s fertility challenges.

As of 2023, the youth unemployment rate (ages 15-24) stood at 9.7%, nearly double the national average. For those who are employed, many are stuck in precarious or low-paying jobs, such as retail and gig work, which offer little financial security or career advancement.

This unstable job market leaves a significant portion of young adults financially dependent on their parents or partners, delaying milestones like homeownership and parenthood.

Moreover, underemployment—a situation where individuals work part-time or in roles below their qualifications—affects nearly 30% of young Canadians, according to a report from RBC Economics. This economic insecurity further exacerbates the challenges of starting a family.

Meanwhile, the cost of living continues to rise. Food prices alone have become a major concern, with the average Canadian household now spending over $14,000 annually on groceries, according to the University of Dalhousie’s 2023 Food Price Report. For young Canadians, many of whom already face significant student debt, these escalating costs make it difficult to imagine supporting a child.

Unsurprisingly, many are exploring emigration as an alternative. Which is also one of the driving reasons we decided to make this site.

Our goal is to help Canadians or anyone else, find countries with stronger job markets and lower costs of living to offer the prospect of financial stability and a better quality of life.

For Canadians looking to build a future in a family-friendly environment, emigration may provide the opportunity they need. Learn more about these options in our article on Canada’s reverse immigration trends.

5. Lifestyle Priorities Are Shifting

Finally, shifting societal values and priorities are playing a major role in Canada’s dropping fertility rate.

For many young people, achieving financial independence, advancing their careers, and maintaining a certain quality of life have taken precedence over starting a family.

These priorities are shaped in part by the economic pressures mentioned earlier. When individuals are forced to choose between having children and achieving financial stability, the latter often wins out.

For those who feel Canada’s economic environment makes raising a family untenable, it might be time to consider relocating. Many Canadians are finding that life in other countries offers the affordability and stability they’re seeking. Our how-to guide on leaving Canada provides valuable tips on making this transition.

Is There a Way Out?

Canada’s dropping fertility rate is a complex issue with no single solution. However, for those who feel disillusioned by the current economic climate, there are options. By exploring life in other countries, you might find a place where raising a family is not only possible but more fulfilling.

If you’re ready to start fresh in a country where financial security and family life are achievable, check out our comprehensive how-to-leave-Canada guide.

Whether you stay or go, understanding the factors driving Canada’s declining fertility rate is the first step toward addressing them. For now, the choice remains yours.

Explore Your Opportunities Abroad

Use the Canadian Exit Guide to see how you can leave Canada to find better opportunities abroad.

Leave a Reply