Canada is often praised as one of the best countries in the world to live in. We have a stable democracy, a diverse and multicultural society, a universal health care system, and a rich natural environment. We are also among the top performers in education, innovation, and quality of life. What’s not to love about Canada?

Well, as it turns out, a lot.

Costs are spiralling out of control while wages struggle to keep up, and the future is increasingly uncertain. We’re supposed to believe our standard of living is high, yet many Canadians are just one financial emergency away from disaster. It’s time we took a closer look at what’s really happening and why Canada’s standard of living decline is increasingly hard to hide.

The Great Canadian Housing Heist

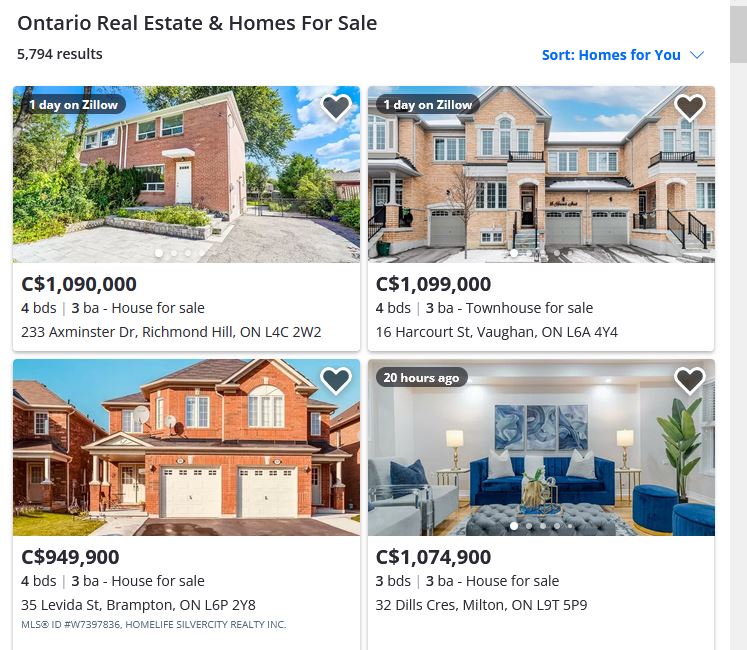

Let’s start with the almighty Canadian dream – home ownership.

What a joke that has become. A few short decades ago, it was easy for average middle-class folks to buy a house with just one income. My parents bought a house in 1990’s for a mere 151K an hour away from Toronto.

Now, even dual-income professional households struggle to afford a tiny condo in cities like Vancouver or Toronto, let alone a million dollar house in the suburbs.

If you are a millennial or generation Z in Canada, you can forget about owning a home.

Unless you are lucky enough to inherit one, win the lottery, rob a bank, you have no chance of affording a decent place to live.

According to a Canadian housing report, the national average home price in November 2023 was $646,134, a 2% increase year-over-year. And according to Daily Hive, Canadians can expect to see a 5.5% increase in prices towards the end of next year — compared with prices in 2023.

The national average for a typical home will be $843,684 Canadian dollars in 2024.

I know a young couple who scrimped and saved for years only to be outbid on every offer. They finally gave up and resigned themselves to renting for life. Now, you might think renting is a normal option in Canada but think again.

According to the December 2023 Rentals.ca Report, the average rent for a one-bedroom apartment in Toronto was $2,516, and in Vancouver, it was $2,445 in November 2023. That’s more than half of the median income for Canadians. And don’t expect to get much space for your money.

You’ll be lucky to find a shoebox-sized condo that can fit a bed and a desk, let alone a couch or a dining table. Plus let’s not mention the average $600 in condo fees tacked on in most situations. Meanwhile, your parents and grandparents probably bought their spacious houses for a fraction of what you pay in rent and are sitting on a gold mine of equity.

How did we get here? How did we go from being a nation of homeowners to a nation of renters, or worse, couch-surfers? How did we let our housing market become so unaffordable and inaccessible for so many of us?

And who is to blame for this madness? Some experts point the finger at foreign buyers, who have been snapping up properties as investments, driving up the demand and the prices. Others blame the lack of supply, as governments have failed to build enough affordable housing or incentivize developers to do so.

Still, others blame the easy credit, as low-interest rates and lax lending standards have encouraged people to borrow beyond their means. But the real culprit is none other than the Canadian government, which has been using the housing market as a cash cow, collecting billions of dollars in taxes and fees from home buyers and sellers while doing nothing to address the underlying issues.

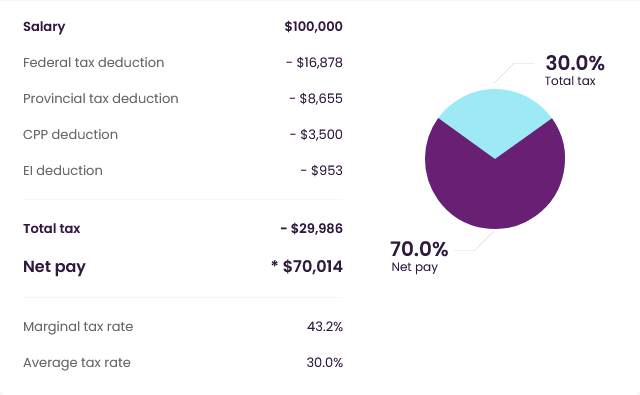

Taxed to Death (and Taxed Some More)

As if paying a fortune for a roof over your head wasn’t enough, you also have to pay a fortune to the government in taxes. Canada has one of the world’s highest personal income tax rates, with the top marginal rate reaching 54% in some provinces.

Although this high tax rate helped keep Canada’s standard of living high, it’s clear today the tax dollars are not giving the citizens and new immigrants the return on their investments.

That means that for every dollar you earn above a certain threshold, you only get to keep 46 cents. And that’s not counting the sales taxes, property taxes, payroll taxes, and other taxes that you pay on everything you buy and own.

You might think getting a raise would help you cope with the high cost of living, but think again. In some cases, getting a raise can actually make you worse off because it pushes you into a higher tax bracket, where you pay more taxes and lose some of the benefits and credits that you were eligible for before. It is called the “tax trap,” affecting millions of Canadians yearly.

Taxes are supposed to fund the public services and programs we need and enjoy, such as health care, education, infrastructure, and social security.

Taxes are also supposed to redistribute wealth and income and to correct market failures and externalities, such as pollution and climate change. But are taxes REALLY doing what they are supposed to do in Canada? Are we getting good value for our money? Are we paying our fair share? Or are we being taxed to death and taxed some more by a greedy and wasteful government? The answer, unfortunately, is the latter. Canadians are among the most heavily taxed people in the world and are not getting much in return.

Canadians’ tax burden is also higher than most developed countries. According to the Organization for Economic Co-operation and Development (OECD), a group of 38 wealthy nations, Canada ranked 10th highest in terms of the tax-to-GDP ratio. Canada’s tax-to-GDP ratio was 32.4%, higher than the OECD average of 31.3% and higher than countries such as the United States (24.5%), Australia (28.7%), and Switzerland (28.5%).

Canada also ranked 10th highest in terms of the tax wedge, which measures the difference between the labor cost to the employer and the net take-home pay of the employee. Canada’s tax wedge for a single worker with no children was 30.5%, higher than the OECD average of 25.9% and higher than countries such as the United Kingdom (25.8%), Japan (22.4%) and New Zealand (17.9%). What do Canadians get for paying such high taxes? Not much, apparently.

The government keeps introducing new taxes, such as the carbon tax, which is supposed to fight climate change but just makes everything more expensive, from gas to groceries. They claim the carbon tax is revenue-neutral, meaning it gives back what it takes, but that’s not true. The government keeps a large chunk of the revenue for itself and distributes the rest in a way that benefits some people more than others. So, thank you, dear government, for taking half of our hard-earned money and giving us nothing in return. We appreciate it.

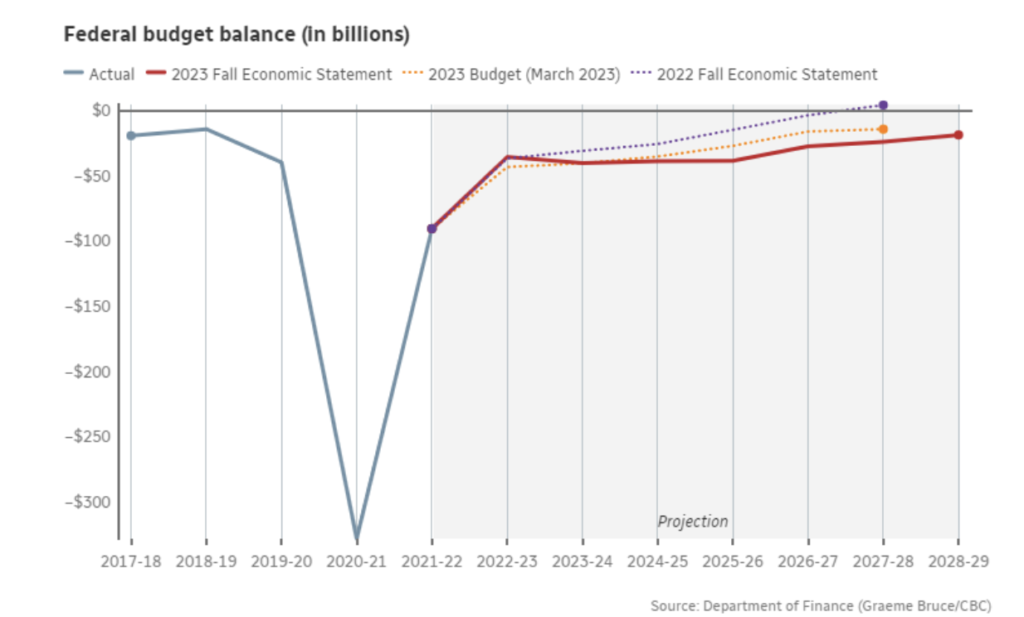

3. Canada’s Doomsday Deficits

Remember when deficits were a bad thing? When politicians used to promise to balance the books and pay off the debt? When we used to worry about the future of our children and grandchildren? Well, those days are long gone. Now, deficits are the new normal, and our kids will be paying them off until the end of time. Or until the creditors come knocking, whichever comes first.

Just look at this chart, showing how the federal government’s spending has been growing faster than its revenues for years, resulting in a widening gap between the two. In 2023, the gap reached a record high of $46.5 billion, or 1.7% of GDP.

That’s more than the total deficits of the previous five years. And that’s not counting the provincial and municipal debts, which increased to $1.3 trillion by the end of 2021.

You might wonder where all that money went. Well, some of it went to support Canadians during the COVID-19 pandemic, which is understandable. But a lot of it went to wasteful spending that we’re on the hook for, such as:

- $43 billion in net new spending over six years, which increased the federal debt to $1.18 trillion and the debt-to-GDP ratio to 47.5% by 2023.

- $359 million over five years for programs addressing the opioid crisis, which critics say is insufficient and ineffective given the rising number of overdose deaths and the lack of safe supply and decriminalization.

- $1.5 billion over five years for the Canada Media Fund, which some argue is a subsidy for legacy media outlets that are losing relevance and audience in the digital age.

- $35 billion on the Canada Infrastructure Bank, which has been slow to deliver on its mandate of attracting private investment for public infrastructure projects, and has faced allegations of political interference and lack of transparency.

And the list goes on. The sad part is that these are only the tip of the iceberg. There are probably many more examples of fiscal waste that we don’t even know about. And the worst part is, we’re not even getting any value for our money. Our economy is still struggling, our healthcare system is still underfunded, and our public services are still deteriorating.

So, what does this mean for our future? Well, it means our grandkids will be taxed to the hilt to pay for today’s overspending. It means we will have less fiscal room to deal with the challenges of an aging population, climate change, and global competition. It means that we will be more vulnerable to external shocks, such as rising interest rates, currency fluctuations, and trade disputes. And it means that we will be less prosperous, less secure, and less free.

Isn’t that a great legacy to leave behind?

Number 4: The Great Immigration Con

Another factor that contributes to Canada’s standard of living decline is the immigration policy. Canada is known for being a welcoming and diverse country where immigrants can find opportunities and contribute to society. But is this really the case? Or is it a great con that benefits only a few while hurting the rest of us?

Just look at the data showing how high immigration levels are straining our infrastructure and housing. Canada is going to admit 485,000 new permanent residents in 2024 and plans to accept 500,000 annually in 2025 and 2026. That is the highest level of immigration in Canadian history and far exceeds the natural population growth. In fact, immigration accounts for about 80% of Canada’s population growth.

But where are all these newcomers going to live? How are they going to get around? How are they going to access health care, education, and other public services? The answer is that they are going to compete with the existing population for the limited and already overstretched resources. According to Statistics Canada, there is a shortage of about 1.8 million housing units in Canada, of which 1.3 million are in urban areas.

According to the Canadian Automobile Association, traffic congestion costs Canadians $15 billion a year in lost productivity, wasted fuel, and environmental damage. According to the Fraser Institute survey, wait times for healthcare services have increased by 50% since 2015 and are among the longest in the developed world.

But what about the immigrants themselves? Are they better off in Canada? Are they finding good jobs and integrating into society? The answer is not really. Many immigrants are struggling due to the lack of good jobs, the mismatch of skills and credentials, and the discrimination and racism they face. According to Statistics Canada, immigrants who became permanent residents in 2018 had a median wage of $31,900 in 2019, which was 17.8% lower than the Canadian median wage in the same year ($38,800).

According to the Environics Institute, 42% of immigrants reported experiencing discrimination or unfair treatment based on their ethnicity, culture, race, or skin color. According to the Angus Reid Institute, 39% of immigrants said they felt like outsiders in Canada, and 29% said they had trouble making friends with Canadians.

But what about the economy? Aren’t immigrants supposed to boost the economy and wages? Isn’t that the main argument for high immigration levels? The answer is no. There is no evidence that immigration has a positive impact on the economy or wages. In fact, there is evidence that immigration has a negative effect on both.

So, who benefits from this immigration policy? Not the immigrants, who are often exploited and marginalized. Not the Canadians, who are often crowded and taxed. Not the economy, which is often stagnant and uncompetitive. The only ones who benefit are the politicians, who use immigration as a tool to win votes and appease special interests. The politicians who tell us that we are helping the world while hurting ourselves. The politicians are selling us an excellent immigration con.

Escaping Canada’s Standard of Living Decline

Decades of poor policy choices are catching up to Canada. Sky-high housing costs, crushing taxes, massive deficits, and unsustainable population growth have led to Canada’s standard of living decline. We’re told to accept the “new normal,” but there’s nothing normal about working more to afford less. Future generations deserve better than the financial mess we’re leaving them.

It’s time for severe reforms before it’s too late. Governments must curb reckless spending, rein in deficit addiction, and enact policies that make housing and costs of living affordable once more. Immigration levels also need to be reduced to sustainable levels that don’t undermine wages and quality of life. Most of all, we need more honest conversations about these challenges rather than pretending everything is fine. The problems won’t fix themselves, and our kids shouldn’t have to pay the price for our collective failure to act.

Here’s to hoping it’s not too late to turn this ship around. And if you’re young and reading this and looking to expat-it-up, your in the right place. it’s never to late to take your future into your own hands. If you’re thinking of flying the Canadian Coop, We’ve developed a comprehensive guide to help you get your ducks in order before leaving Canad forever or for an extended vacation. Check out the guide today:

Explore Your Opportunities Abroad

Use the Canadian Exit Guide to see how you can leave Canada to find better opportunities abroad.

Leave a Reply