Why Most Canadians are Debt Slaves: Decoding the Canadian Debt Dilemma

No, it’s not ME who is saying Canadians are debt slaves it’s the data!

While many Canadian politicians proudly boast about their Rising Star status on the global stage, what they may not realize is that research consistently finds they wear another label just as prominently – OECD’s star Debt Slaves!

How did this happen? And what are the consequences for individuals, newcomers, and the country as a whole entering a society laden with debt?

That is what this article is going to decode. Through analyzing borrowing trends, policy impacts, and long-term risks, the following sections will unpack this towering problem and shed light on its sobering implications for those planning to come to or leaving Canada.

The Scale of Canadian Debt

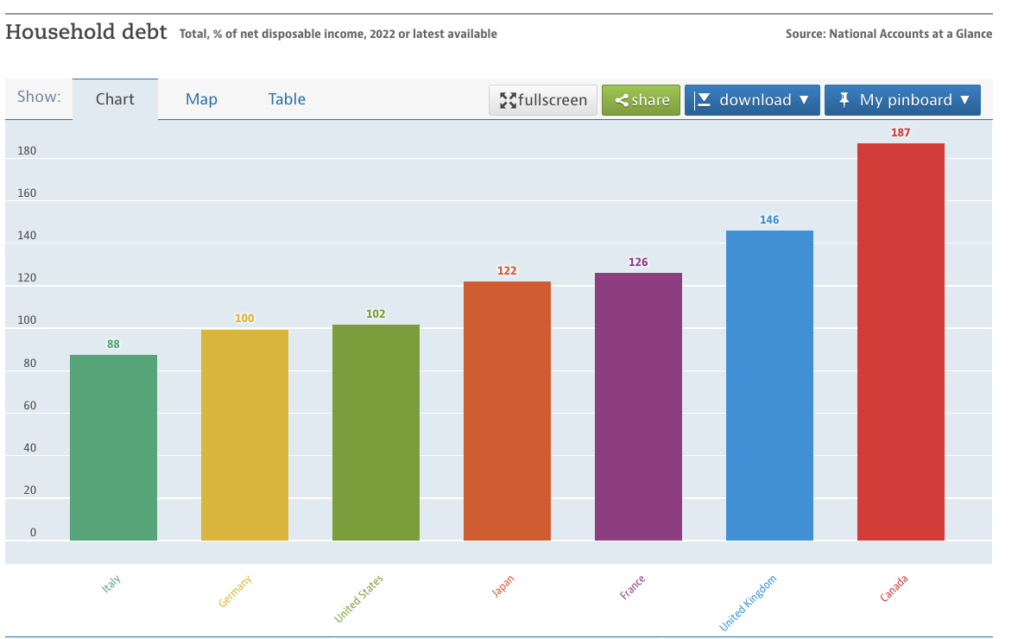

According to the latest OECD Data, Canada has the highest level of household debt among the G7 member countries. As of the first quarter of 2024, Canada’s household debt ratio is 187%, meaning that Canadians have twice as much in liabilities as they are worth.

In comparison, the average household debt ratio for the G7 is 124% and the lowest is Italy’s with 87.6%.

Clearly, Canada is leading the pack in this dubious race.

And what kind of debt are we talking about?

Well, most of it is mortgage debt, which accounts for 66.5% of the total household debt. It is not surprising, given the soaring housing prices in many Canadian cities. The rest of the debt is composed of consumer credit (28.7%), which includes credit cards, car loans, student loans, and other personal loans, and non-mortgage loans (4.8%), which have lines of credit and home equity loans.

Now, let’s look at how much debt the average Canadian carries. According to Statistics Canada, the average household debt-to-income ratio was 170.7% in the third quarter of 2023, meaning that for every $100 of income, Canadians owed $170.7 in debt. This ratio varies across income groups and regions, with the lowest-income households and those living in Atlantic Canada having the highest ratios and the highest-income households and those living in Quebec having the lowest ratios.

Why does this matter? Well, because these metrics tell us a lot about Canadians’ financial health and vulnerability. They indicate how much Canadians rely on debt to finance their lifestyles, how much they are exposed to interest rate changes and economic shocks, and how much they save for the future. In other words, they show us how much Canadians live beyond their means and how much trouble they could be in if things go south.

Factors Contributing to Canada’s Debt Situation

So, what economic factors have contributed to Canada’s debt situation? Well, there are several, but we will focus on the most important ones:

Factor 1: Low-interest rates

Since the 2008 global financial crisis, the Bank of Canada has kept its key interest rate at historically low levels, ranging from 0.25% to 1.75%. That has made borrowing cheaper and more attractive for Canadians, especially for mortgages and consumer credit.

Low-interest rates have encouraged Canadians to save less and spend more, as the returns on savings are negligible.

Factor 2: Hot housing market

Throwing fuel on the fire is our housing market, which has seen a rapid increase in prices and demand in recent years. Many Canadians have taken on large mortgages to buy homes, often with low down payments and long amortization periods. This has exposed them to the risk of housing bubbles, price corrections, and negative equity. Moreover, some Canadians have used their homes as ATMs, tapping into their home equity to finance other purchases or debts.

Factor 3: Easy credit

Another factor that has fueled Canada’s debt culture is the accessibility and availability of easy credit. Canadians have access to a variety of credit products, such as credit cards, car loans, payday loans, and installment loans, which often have high-interest rates and fees. These products are marketed aggressively and conveniently, making it easy for Canadians to borrow more than they can afford or need.

Factor 4: Lack of financial education

Few understand things like compound interest, debt servicing, or budgeting basics. Many Canadians don’t have a budget, a savings plan, or a debt repayment strategy. They don’t know how to compare different credit options, negotiate better terms, or avoid predatory lenders. They are often unaware of the resources and programs available to help them manage their finances. So, they’re easy prey for predatory lending practices.

Factor 5: Government policies

Finally, some of the government policies and programs have also contributed to Canada’s debt situation. For example, the mortgage stress test, which was introduced in 2018 to ensure that borrowers can afford their mortgages even if interest rates rise, has been criticized for being too strict and limiting access to homeownership for many Canadians.

On the other hand, some of the COVID-19 relief measures, such as the Canada Emergency Response Benefit (CERB) and the Canada Recovery Benefit (CRB), have been accused of being too generous and discouraging work and savings. These policies have had mixed effects on the debt levels and behaviors of Canadians.

What Moving to Canada Means for Newcomers

Now, what does moving to Canada mean for newcomers? Well, Canada prides itself on being a multicultural and welcoming country, but immigrants soon discover that diversity doesn’t protect them from the country’s pervasive debt culture.

Coming to Canada with high aspirations and hopes, nothing can be more shocking than realizing that the same financial pressures that afflict the locals also threaten the newcomers. For those who seek to move to Canada through studies or visas, the challenges are numerous. Some of the problems you might face are:

A Lot of Debt: You may also have to deal with the debt you brought from your home country, or the debt you incurred during the transition process.

- Temptation Avenue: The Canadian lifestyle often encourages newcomers to participate in consumerist lifestyles. Withstanding the temptation of materialism requires substantial effort.

- Real Estate Hurdles: Buying and selling real estate in Canada is like gambling with high stakes. You may encounter challenges such as engaging in competitive bidding wars or reluctantly accepting suboptimal living arrangements due to inflated real estate prices.

- Hard to Start Over: You will have to find a place to live, a job, and a way to get health care. But these things may be hard to do if you have a lot of debt or not enough money.

- Lack of information: Newcomers may lack information or awareness about the Canadian financial system, such as the banking, credit, or tax systems. They may also be unfamiliar with the resources or programs available to help them with their finances.

To avoid the debt trap in Canada, newcomers need to adopt some strategies and practices, such as:

- Saving: Newcomers need to save money for their short-term and long-term needs and wants. Saving can help you avoid or reduce debt, as well as prepare for unexpected events or opportunities.

- Spending: Newcomers need to spend money wisely and responsibly. You need to distinguish between your needs and wants and prioritize your spending accordingly. You also need to avoid impulse buying and compare prices and quality before making a purchase.

- Borrowing: Newcomers need to borrow money carefully and cautiously. Borrowing can help you achieve your goals and dreams, but it can also create debt and problems. You need to borrow only what you need and can afford to repay and avoid high-interest or risky debt, such as credit cards, payday loans, or installment loans.

These are some of the implications, insights, and strategies for newcomers in Canada’s debt culture. By being aware and proactive, you can improve your financial situation and well-being.

Looking Beyond the Numbers: Long-Term Consequences

There is a big debt culture in Canada which is not only a problem for the present but also a threat for the future. If the current debt trend persists, it could have serious long-term consequences for the country and its people. Here are some of the possible outcomes and challenges:

Challenge #1: Economic growth

Canada’s debt could hamper its economic growth, as it reduces the amount of money available for productive investment, innovation, and entrepreneurship. High debt levels also make the economy more vulnerable to external shocks, such as interest rate hikes, currency fluctuations, or trade disputes. Moreover, high debt levels could undermine consumer confidence and spending, which are key drivers of economic activity.

We see this already with a lot of Canadian capital being funnelled into non-productive assets like real estate which often doesn’t employ many people or contribute to the job market.

Challenge #2: Economic stability

Canada’s debt culture could jeopardize its economic stability, as it increases the risk of financial crises, defaults, or bankruptcies. High debt levels also make the economy more dependent on foreign borrowing, which could expose it to capital flight, exchange rate volatility, or sovereign debt ratings downgrades. Furthermore, high debt levels could limit the fiscal and monetary policy options available to the government and the central bank, which could constrain their ability to respond to economic shocks or emergencies.

Challenge #3: Wealth distribution

Canada’s debt culture could worsen its wealth distribution, as it creates a gap between the rich and the poor, the savers and the borrowers, and the owners and the renters.

High debt levels also exacerbate the inequality of opportunities, as they affect access to education, health care, or housing. Additionally, high debt levels could increase social and political tensions as they create resentment, frustration, or anger among different groups of people.

So, is there a way out of Canada’s debt trap? Or are Canadians debt slaves forever? Well, there are some potential solutions to alleviate Canada’s debt burden. Here are some of them:

- Regulation: The government could implement stricter and smarter regulation of the financial sector, such as imposing higher capital requirements, limiting leverage, or enhancing consumer protection. This could help prevent excessive or irresponsible lending, borrowing, or speculation and promote financial stability and transparency.

- Education: The government and society could invest more in financial education and literacy, such as providing more resources, programs, or campaigns. It could help raise the awareness and skills of the people and encourage them to make informed and responsible financial decisions.

- Incentives: The government and society could create more incentives and opportunities for saving, investing, or entrepreneurship, such as offering lower taxes, higher returns, or more support. This could help increase the income and wealth of the people and reduce their reliance on debt.

Finding a Way Out – Exiting Canada

While Canadians enjoy a high standard of living and strong economy on the global stage, this comes at the cost of shouldering disproportionate debt loads that undermine financial resilience.

However, if you’re concerned about the increasing Canadian debt burden, you can always invest your assets in country which is growing it’s GDP. To find these safe havens to safeguard your assets, consider taking our Leaving Canada Quiz below where we can match you with a country that suits your personality based on 22 parameters.

Looking to leave Canada?

Take the country quiz to see where you belong!

Leave a Reply