Argentina has long been an expat magnet due to it’s unique culture, beautiful weather, and extreme affordability. However, due to recent changes in it’s government, the sentiment for emigrating to Argentina has shifted for the worse – leaving many asking: Is Argentina still good for expats?

Let’s unpack the reasons behind Argentina’s financial issues and see if a move to Argentina is still right for you.

Is Argentina Still Good for Expats Under the Milei Government?

In December 2023, the infamous libertarian Javier Milei became Argentina’s president beating out the long time Peron government. Part of Milei’s popularity stemmed from a double whammy of his promises to fix the the country’s financial problems and his unorthodox media presence.

Argentina’s situation is critical. The changes our country needs are drastic. There is no room for gradualism, no room for lukewarm measures.”

– Javier Milei

President Javier Milei dove head-first in addressing Argentina’s economic issues: rampant inflation, a corrupt government, and significant national debt. Sticking to his campaign promises, after Milei came into power he started down a rigorous path to reform and stabilize the national currency.

Today the results of these policies are showing up strong. Milei’s aggressive subsidy cuts and a devaluation of the peso, which was intended to improve Argentina’s trade competitiveness and reduce public expenditures have been causing pain for the populace and expats.

From the cost of living surging as subsidies on utilities and essential services were slashed, and the peso devaluation causing increased prices for imported goods, the economic shock is hitting the country hard.

But is this just a classic example of the old adage that not all beneficial changes are painless? Or will the impact of these fiscal changes leave a strain on both locals and foreigners residing in Argentina indefinitely?

As we look further into the situation in Argentina, it’s clear that the adjustments are a double-edged sword. They promise long-term benefits but bring short-term hardships that affect all residents, regardless of their economic standing. Expatriates, in particular, need to re-calibrate their financial strategies to navigate this new economic landscape effectively.

Prices Have Risen in Argentina Squeezing Tourists and Locals

Argentina was once lauded for it’s affordability, but has now taken a turn for the expensive side. For anyone thinking about coming here, it’s essential to realize that prices have risen since Milei has dropped price controls.

To paint you a better picture, all daily essential items are have exploded in price. Coffee is now around 3 USD for a cappuccino. Which, for an American or Canadian doesn’t seem bad, but for a local Argentinian or a shrewd expat, it can add up overtime.

When it comes to keeping warm, that’s gotten expensive as well. Utilities for your apartment have doubled and empirical evidence from the YouTuber Russian with Max stated that his apartment’s utilities jumped from around 40 USD a month to roughly 150 USD/month for a small 30 m2 flat.

Furthermore, according to Euro Times, transportation such as trains and buses has spiked, hurting the pockets of commuters. While the total cost is for public transit is still under 1 USD, the velocity of it’s price hikes are worrying Argentinians and budget conscious expats on Argentina’s long term viability as a cheap country.

Subsidy Cuts and Currency Devaluation are Driving Price Spikes

But what’s the reason behind these rising prices? It’s quite simple: Subsidy cuts and currency devaluation. The Milei government has made drastic changes, including the removal of subsidies for utilities, transportation, and food, alongside cancelling tenders for infrastructure projects. Moreover, the Argentine Peso has been devalued by 50%.

This devaluation is part of a broader strategic move to bolster Argentina’s long-term economic standing on the global stage by making its exports lower priced, thus attracting more international buyers. This could potentially transform Argentina into a preferred market, creating a juicy trade surplus that would help avoid deficits.

However, these measures have immediate drawbacks, primarily the stripping of purchasing power of the Peso in Argentina. So much so, that expatriates and locals alike are feeling the pinch as everyday expenses rise sharply. This situation is expected to pressurize living costs further in the short term, and those planning to move to or currently living in Argentina should brace for continued economic turbulence.

Extreme Import Prices are Hurting Locals

Another reason why we’re cautioning living a life in Argentina is due to their import control policies. Argentina’s import controls have created large barriers for accessing high tech consumer goods. These controls can significantly affect expatriates, particularly digital nomads who rely on high-tech products to complete their work.

The country’s tight policies and newly implemented protectionist measures inflate the costs of high-end electronics like Apple devices and laptops which are often priced 100 – 150% higher than in the U.S. due to a mix of inflated taxes, currency fluctuations, and corruption.

For digital nomads, who rely heavily on access to affordable, quality technology for their mobile lifestyles, this presents a possible burden – especially if they’re living on a budget. In light of these issues, if you’re an expat or nomad looking to come into Argentina we would advise you to prepare heavily before relocating to Argentina by purchasing the necessary electronics in your home country.

Unpredictable Inflation and Currency Dynamics

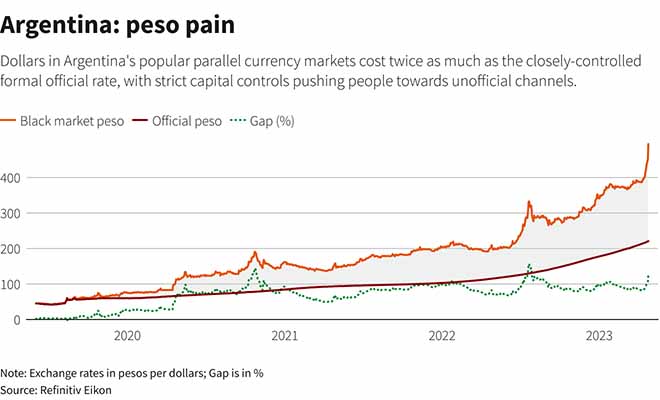

The Argentinian peso is known for its volatility, often moves up and down like a bipolar butterfly within a single day. Due to this, people living here are used to several variations of the peso which all have different exchange rates and can contribute to increased headaches for expats here.

For example there’s the “Blue Peso” which is the black market exchange rate for 1 Argentinian Pesos to 1 US Dollar, is much higher than than the Official rate, due to it’s fluctuation throughout the day.

The changes in exchange rates even created unique versions of the peso like the “Qatar and Coldplay peso.” These forms came as Argentinians travelled to the FIFA World Cup and Coldplay concerts, highlighting the currency’s feebleness and susceptibility to external events.

These inflationary currency changes leave the locals struggling and it’s only been exacerbated in 2024 under the Milei administration which saw the peso’s value halved in a bid to boost trade, severely impacting the purchasing power of Argentinians.

These economic shifts not only deepened the financial crisis but have also sparked civil unrest as the government fights with these challenges.

Expats should be wary of an expected rise in petty crime. Furthermore economic desperation among Argentina’s poorest—those unable to earn in more stable foreign currencies—has increased, heightening the risk of such crimes.

Even with these factors, Agentina remains a vibrant destination for wealthier expats, but it’s essential to come here with a level of caution, particularly in the current economic climate. Either way, wealthier expatriates will still find opportunities in Argentina, especially those capable of navigating the economic landscape with sufficient financial buffers or those earning money in stable foreign currencies.

Forget About Owning a House In Argentina

Another reason to rethink living in Argentina is the absurdity of it’s housing market. I spent a few days researching home buying here and realized that if you thought Canada’s housing crisis was bad, Argentina’s purchasing conditions make Canada’s market seem sane.

Let me explain.

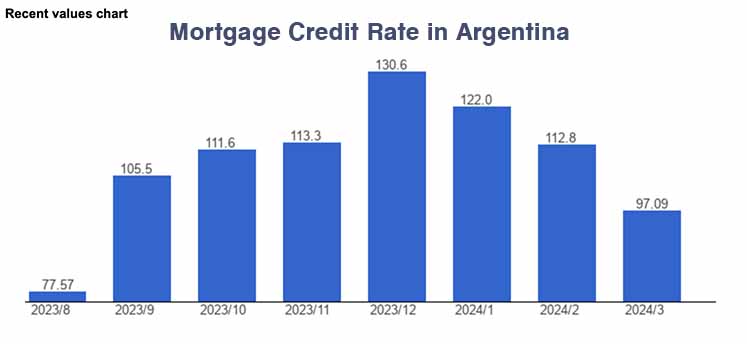

In Canada and the USA, mortgage rates are hovering around 6 – 7%. For Argentina a 5-10 year mortgage interest rate is 97%+ in 2023. Although down from their plus 100% mortgage credit interest norms, it’s still quite an absurd rate for most people.

Furthermore, if you’re looking to purchase a home in Argentina you better have the US dollars and enough to buy it outright in cash. This is for two reasons. Firstly an all cash deal in US dollars will give you more negotiating power, and secondly mortgages are only offered in the Argentinian Peso which could devalue at any point.

So what should one do? If you’re an Argentinian or an expat living there it’s essential to receive your income in a safer currency than the Argentine Peso in institution outside of the country. Check out our tips on banking abroad here for ways which you can do this. And, when you have your income in USD, EUR, CAD or British Pounds, you can comfortably still live in Argentina and weather their financial storm.

Worry Less About Your Finances while Overseas

Keep your finances in order in Argentina with our new Banking Abroad Guide.

Final Thoughts – Is Argentina Still Good For Expats?

Okay, so now comes the million peso question: the final verdict for living in Argentina in 2024. As of now, we believe Argentina will get worse before it gets better.

With it’s recent change in government, Argentinians will go through a turbulent time of uneasiness and possible social unrest causing some stress for people in the country. We predict that this will be prevalent in the short term (1-3 years) but, if you have your business, work, or side-hustle returning money in stable currencies, Argentina is still a reasonably good option for expats looking for adventure on the south-side of the equator.

Leave a Reply