Due to Canada’s cost of living crisis, many Canadians are looking at countries beyond the Great White North to spend their golden years and silver dollars.

Whether its economical reasons, environmental reasons, or just for a change of pace, the search is on for where Canadian pensions go farthest.

Luckily, for those brave soles looking to branch out, we’ve come up with 5 countries where where Canadian pensions go farthest.

Now let’s take a look.

Understanding Alarming Pension Trends in Canada:

If you’re a retiree reading this, consider yourself in a great position. Employer defined pensions are on the decline and many younger Canadians have forgotten they even exist. But not all retirees have it easy either. Many didn’t get an employer defined pension plan or if they did, it was quite small or not indexed to inflation.

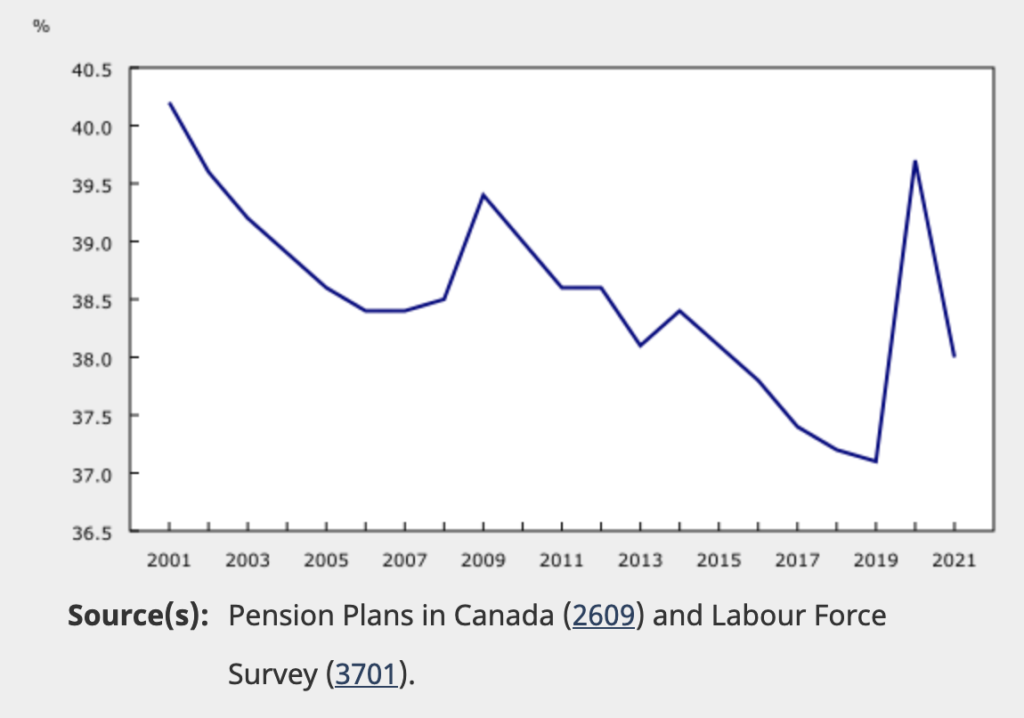

As per Stats Can report, There’s been a steady downward trend for the percentage of the Canadian population with a pension plan.

Regardless of the doom and gloom, there is a bright light at the end of the tunnel.

Retirees can and are turning to other countries due to a lower cost of living, a friendlier climate, and the desire to live a lifestyle unseen in Canada.

Now, if you’re looking to for places where Canadian pensions go farthest to enjoy your golden years, you will have to consider these following key factors:

| Cost of Living in Retirement Country |

| Local and Taxation Laws for Non-Citizens |

| Healthcare Access and Quality |

| Quality of Life |

| Weather and Climate |

Fortunately, we took these five factors and included in them in our analysis for the 5 countries where Canadian pensions go farthest for you. But first, we must understand the average income for the Canadian pensioner and how much purchasing power they truly behold.

Understanding the Average Monthly Income for a Canadian Pensioner:

About 60 percent of people reading this won’t have a lucrative employer sponsored pension plan. Due to this we will offer two examples of Canada’s average retirement income based on this.

But, to understand the average income of the Canadian pensioner we must look at where the income is coming from.

For the average Canadian they can expect to receive:

- Guaranteed Income Supplement (GIS): This is a financial aid for Canadian seniors who have a low income. GIS provides additional money on top of the Old Age Security pension, offering crucial support to ensure a minimum income threshold for retirees. The amount received depends on marital status and combined income.

- Employer Pension Plan: These are retirement plans offered by employers, which can be defined benefit plans (providing a fixed payout at retirement) or defined contribution plans (the payout depends on the amount contributed and the plan’s investment performance). Participation in these plans is a key component of retirement planning for many employees, as it supplements CPP and OAS income.

- Old Age Security (OAS): The basic OAS pension payment, as of your initial statement, is $713.34 per month. However, this amount can change quarterly due to adjustments for the cost of living as measured by the Consumer Price Index.

- Savings: Personal savings play a significant role in retirement income. This includes money set aside in savings accounts, Registered Retirement Savings Plans (RRSPs), or Tax-Free Savings Accounts (TFSAs). The amount accumulated over one’s career can provide a substantial financial cushion in retirement.

- Investment Income: Income can come in the form of dividends (payments made by companies to their shareholders) and distributions (such as those from mutual funds or income trusts). The right investment strategy can provide a steady stream of income in retirement, alongside capital growth.

However, not everyone will have savings or investment income after living in Canada until 65. So, even we will simulate it where someone retires with a low and moderate retirement income.

Looking at Average Retirement Scenarios:

| The ‘Low Income Retiree’ – Assumes low savings, and no employer pension plan | The ‘Classic Canadian Retiree’ – Assumes Employer Pension Plan plus Government benefits |

| CPP: $725 | CPP: $725 |

| OAS: $713.34 | EPP: $2,616 phttps://www150.statcan.gc.ca/n1/en/daily-quotidien/230502/dq230502a-eng.pdf?st=iVe0bO_N |

| GIS: (Unavailable after 6 months out of the Country) | OAS:$713.34 |

| Total: $1,438.34 CAD | Total: $4,054.34 |

As we can see, if you’re one of the lucky people to have an employer sponsored pension plan, you will be quite well off in most countries outside of Canada. For the Low Income Retiree, you’ll have a tougher time, but still, the total income is enough to make do in these next countries I’m about to introduce you to.

Canadian Tax Implications to Considering When Retiring Abroad

Speaking of selling assets, if you are taking the leap and selling your property to relocate, it will attract taxes.

Sometimes, it’s better to hold onto your Canadian property here (if you have one) to keep ties and also use it for rental income while abroad.

The amount of tax will depend on if you have acquired a new residence in another country. Before acquiring a residence in a new country, you should be exempted from principal residence taxes.

Selling property after acquiring residency in another country and the Canada Revenue Agency establishes it, you will not be exempted from the Principal Residence taxes, which will attract capital gains to the sale. Failing to sell your property will accrue interest could really put a damper on your fun in the sun.

Furthermore, if you’re looking for ideas around avoiding Canadian Departure taxes, or when you’ll get charged Non-Resident taxes, check out our guide below for more detail on taxes when leaving Canada:

How to Leave Canada – The Practical Guide

A practical guide to escaping Canada, handling your taxes, and maintaining or renouncing your residency status while overseas.

Destinations: Where Canadian Pensions Go Farthest

Now it’s time to look at what you’ve all been waiting for. Finding out where Canadian pensions go farthest

When choosing these countries, we chose five critical areas in which to score them. These are:

| Category | Explanation and Weight |

| Healthcare | Affordable, available, and high-tech |

| Taxation | Low restrictions to Canadian |

| Climate | Not too cold, with a preference for warmer areas |

| Cost of Living | The lower the better |

| Quality of Life | High human development index (HDI) |

We’ve looked through our popular emigration hotspots database, researched the web, and asked Canadian retirees and expats to point us to these findings and understand the top destinations where your Canadian pension goes the furthest.

Please note:

Some countries with cheap living costs were exempted due to high crime rates, unaffordable or lack of good solid health care, an unstable economy, poor safety index, and difficulties in acquiring a visa.

Now behold the golden list:

1. Malaysia

Malaysia takes top spot on our list because it offers a little bit of everything for any retiree. From beaches, skyscrapers, and immense jungles, you’ll fit in somewhere in this beautiful country.

Malaysia has a cost of living index (CLI) of 35.0 which, to put it in simple terms means it’s extremely cheap. For reference Canada’s CLI is 75+ on average. The process for obtaining a visa is straightforward, and requires a low amount of capital to obtain. You’ll also experience a housing price shock as in Malaysia, houses and condos are quite reasonable at 100,000 CAD plus.

Furthermore, The healthcare system is efficient and affordable, and English is widely spoken, making it easier for Canadian expats to adapt.

Finally, Malaysia is one of the most developed nations in the ASEAN region. It boasts a Human Development Index (HDI) of 0.803 making it suitable to Canadian standards.

2. Romania

Romania takes the second spot on our list because of it’s affordability, temperate climate, delicious food, and strong healthcare system. From it’s towering castles dotted across the Carpathian landscape to the metropolitan oasis of Bucharest, it’s a modern-day fairy tale living for any retiree heading to Romania.

Romania’s cost of living index (CLI) is 38.0 which, to puts it at about half as expensive as Canadian living. And that’s playing it safe. Getting your Romanian visa for extend periods of stay is also quite simple and welcoming for retirees. Housing prices are also quite reasonable compared to Canada. According to Romania Experience, you can purchase a 2-bedroom apartment for 90,000 euros.

Furthermore, Romania has an excellent universal healthcare system which is high-quality and offers fast and effective healthcare services across the country.

Finally, Romania boasts one of the highest developed nations in Eastern Europe with an HDI of 82 making it suitable for Canadian retirees.

3. Panama

Panama takes the third spot on our list due to it’s very affordable and high-quality healthcare system, unique tax perks, and large concentration of expats there making it quite likely you’ll find a friend here. While Panama is known for it’s canal system, it also is known as great place for pensioners with their special Pensionado visa, available to all retirees with an income of 12,000 USD / year and provides several discounts on services and entertainment.

Furthermore, it’s affordable cost of living, beautiful beaches, and relative safety, make it a strong candidate for the Canadian looking to live a tropical life in their golden years.

Panama’s cost of living index (CLI) is 45.6 which, makes it reasonable for the Canadian pensioner. Furthermore, Getting a Panamanian visa is straightforward and includes a few easy pathways to aquire it.

Furthermore, Panama’s healthcare system is high quality and their housing costs are reasonable compared to Canada. To put the cherry on top, the HDI in Panama is 80, making it adaptable for Canadian retirees.

Oh, and if you’re looking for a similarly exiting retirement destination, check out Costa Rica aswell!

4. Montenegro

Another place where Canadian pensions go farthest is the underrated country of Montenegro. If you’re looking for a mixture been Mediterranean charm without the high-flying price, Montenegro is the laid back gem you seek.

Montenegro is perfect for Canadians who push are looking to push their pensions due to it’s favorable cost of living, its stunning Adriatic coastline, historic architecture, and rugged interior for those nature lovers.

Montenegro gets 4th on our budget-friendly retirement list due to lovely Mediterranean climate, high quality healthcare, and strong safety score.

While some maybe scared to settle in this Balkan state, many perks are available to retirees willing to make the plunge. Firstly, retirees will enjoy a cheap cost of living. Montenegro’s CLI is 67, making it on par with Mexico’s cost of living. Secondly, Montenegro’s healthcare system is efficient and improving with an expanding array of offerings for the expat community.

Furthermore, Montenegro comes in as a heavy hitter in the Human Development Index at with a hefty 0.832 making it highly developed nation Canadians can feel at home in.

5. Poland

Last but not least is Poland. The Polish people have one key ingredient that is hard to find these days in any country. And, if you guessed, a deep respect for their elders, you’d be right!

Poland has everything a Canadian retiree would ever need. Top-notch medical facilities, high-speed affordable transit, reasonable accommodation, and a friendly population with traditional values.

Furthermore, retirees settling in Poland can look forward to exploring a new world of cultural traditions, the mountains in the south, or even have a beach day in the beautiful city of Gdansk.

Poland has become an international haven for expats all over the world, and so it’s can be a comfortable place for English speakers to hang their hats. Residency is not too hard to achieve and when you do obtain it, you’ll enjoy free healthcare funded by the national health fund.

Now let’s talk hard stats. Poland’s CLI is 42.1 making it significantly cheaper to live in than the USA and Canada. And that’s not even the best part. Poland’s HDI is a whopping 0.876 making it the highest developed on the list.

Success Stories of Canadians Who Got the Most Bang for their Retirement Bucks

Let’s now delve into Canadian Retirees’ experiences in these countries to see if they are really enjoying their stay or regretting their choices.

Gwenith, originally from Canada, relocated to Poland in the late 1990s seeking a better quality of life. Back home, she faced environmental health issues that severely affected her wellbeing. By 2014, having spent 17 years in Poland, Gwenith saw a significant improvement in her health, thanks to the clean air, water, and abundance of fresh food. She enjoys a range of activities in Poland, including hiking, engaging cultural events, and spending time in public libraries. Living in an expat community, she appreciates the affordability and variety of food.

Paul, a British-Canadian, chose Thailand for his retirement at the age of 51, craving a change of scenery. His favorite aspect is the serene Thai River, boasting stunning, secluded beaches and excellent restaurants. Paul appreciates the low cost of living in Thailand but admits he’s apprehensive about returning to Canada’s harsh weather. His only gripes about Thailand are the excessive rainfall at times and the language barrier.

Wrapping up:

It’s crucial to remember that individual interests and opinions vary, so conduct thorough research and consider a preliminary visit to any country you’re contemplating for retirement. And if you’re curious about where you might retire or live outside Canada, our Leaving Canada Quiz can guide you in your decision-making process.

Looking to leave Canada?

Take the country quiz to see where you belong!

Leave a Reply